The most unsettling leaks do not arrive with explosions. They arrive with spreadsheets, metadata, flight manifests, email headers, shell-company registries, and time stamps that refuse to line up with public statements. That is why the latest tranche of documents now circulating as the Episton files has rattled intelligence desks, compliance teams, and editorial boards across continents. The shock does not come from a single revelation. It comes from the pattern you can no longer ignore once you read them end to end.

You already know how modern leaks work. You expect scandal. You expect familiar names. You expect a short news cycle. This one feels different because it documents systems, not episodes. It maps how money, access, data, and immunity moved together over years, often inside legal gray zones that regulators tolerated. If you work in policy, finance, tech, or media, these files challenge assumptions you rely on every day.

Below are ten facts emerging from the Episton files that deserve sustained scrutiny as 2026 approaches. Each carries consequences that reach far beyond the original actors. Each forces you to ask whether the safeguards you trust still function.

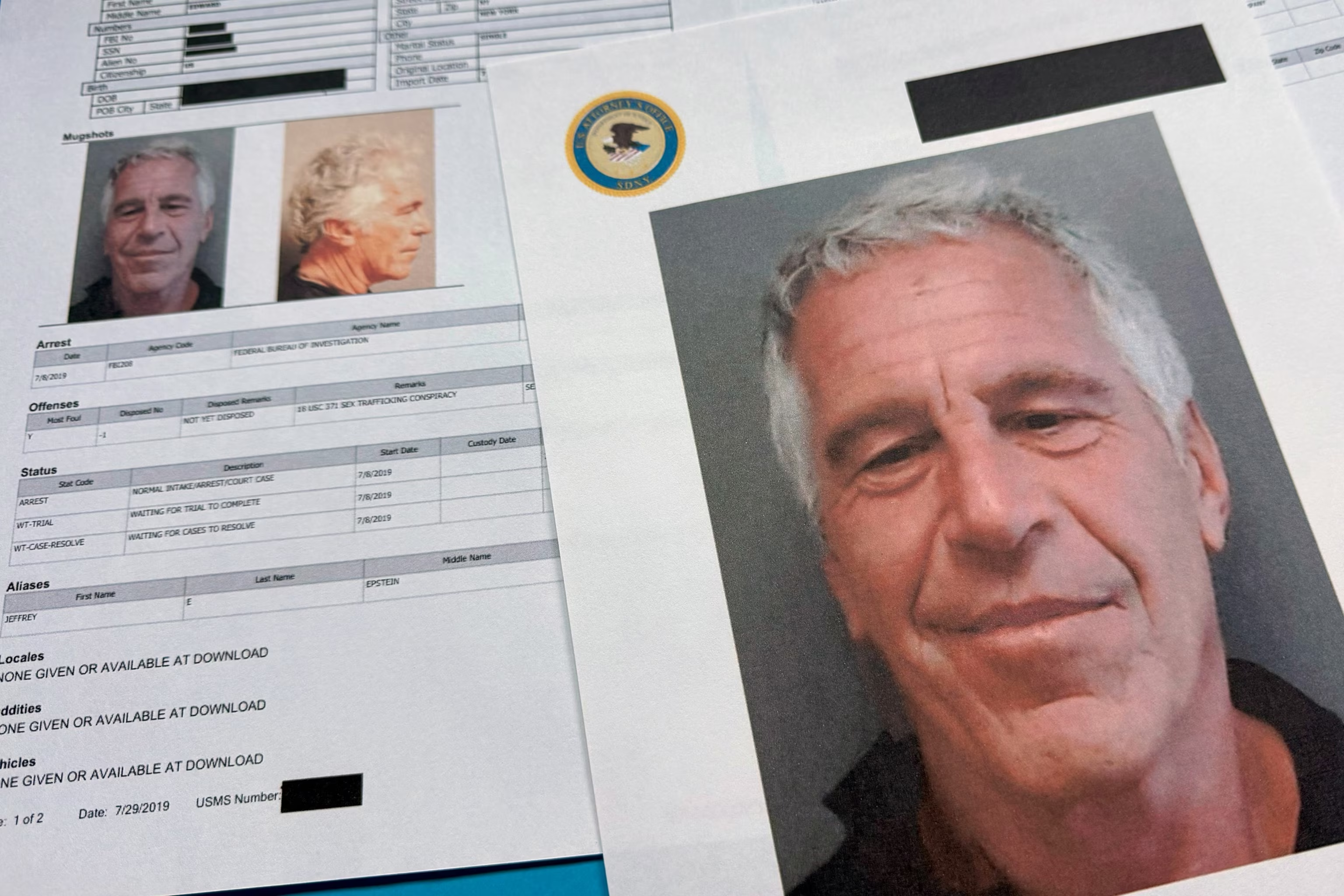

1. The files show a durable architecture, not a rogue network

Public discussion framed earlier disclosures as the work of a single disgraced financier and his immediate circle. The Episton files undermine that comfort. The documents outline an architecture built to outlast any individual.

You see layered legal entities spanning multiple jurisdictions. You see recurring service providers that appear across unrelated deals. You see standardized confidentiality clauses that predate many of the alleged crimes. This did not grow organically. Someone designed it to persist.

Key indicators point to intentional durability.

-

Corporate vehicles recycled under new names after public scrutiny

-

Trustees and directors rotated on fixed schedules

-

Assets shifted into foundations with ambiguous charitable missions

-

Legal opinions reused across years with minimal modification

If you still believe these operations collapsed when headlines faded, the files suggest you underestimate how institutionalized the system became. In 2026, regulators will confront networks that already adapted to past investigations.

2. Financial institutions flagged risks yet continued business

The most damaging sections do not accuse banks of ignorance. They show awareness.

Internal compliance memos included in the files reference enhanced due diligence reviews, reputational risk scores, and client exit discussions. Then you see the accounts remain open. Transactions continue. Relationships shift to different desks.

What explains that contradiction.

The files suggest three pressures dominated decision making.

-

Revenue concentration from high net worth clients

-

Legal comfort derived from outside counsel opinions

-

Fragmentation of risk across subsidiaries

You may recognize this pattern from other financial scandals. The Episton files show it repeated across borders. If you work in finance, you should ask how many similar risk decisions still sit in your institution’s archives, waiting to surface.

3. Intelligence agencies monitored without intervening

Several documents reference briefings to national security services. The language stays careful. It avoids directives. It records awareness.

Analysts tracked movements of individuals and funds due to foreign influence concerns. They noted proximity to sensitive political figures. They documented unusual travel patterns. Then the trail goes quiet.

This raises uncomfortable questions.

-

Did agencies prioritize counterintelligence over criminal accountability

-

Did jurisdictional conflicts stall action

-

Did political considerations override enforcement

You cannot read these sections and believe ignorance explains inaction. The files point toward strategic restraint. In 2026, as governments expand surveillance powers, this history will fuel debate about when observation becomes complicity.

4. Political donations functioned as risk insulation

The Episton files catalog donations that followed a consistent logic. Contributions increased in periods of scrutiny. They flowed to both sides of ideological divides. They targeted committees overseeing financial regulation, justice, and foreign affairs.

You should not reduce this to corruption clichés. The documents show a more subtle effect. Donations purchased access, delay, and ambiguity.

Meeting calendars attached to the files show policy briefings scheduled shortly after investigative milestones. Staff turnover appears to coincide with moments when enforcement could have advanced. This does not prove quid pro quo. It shows how influence reshapes timelines.

In 2026, election integrity debates will not stop at voting machines. They will extend to how money manipulates regulatory clocks.

5. Media gatekeeping limited public understanding

Several journalists will bristle at this point. They should. The files include correspondence between public relations firms and editors that reveals how narratives narrowed.

Editors asked for proof beyond legal standards. Stories stalled pending on-the-record confirmation from sources who faced nondisclosure agreements. Newsrooms weighed defamation risk against public interest and chose caution.

The result was fragmentation. You received isolated stories without connective tissue.

The Episton files include drafts that never ran, legal memos that chilled publication, and talking points that redirected coverage. If you trust the press to surface systemic wrongdoing by default, these documents suggest structural limits remain powerful.

6. Data brokerage enabled private leverage at scale

One of the least discussed sections details data acquisition. The files show purchases of consumer and professional datasets that predate current privacy laws. These datasets linked travel, property, education, and social networks.

Combined, they enabled precise profiling.

-

Identification of gatekeepers within institutions

-

Mapping of personal vulnerabilities

-

Prediction of decision making patterns

You live in a world that debates data privacy as an abstract right. The Episton files show how data functions as leverage infrastructure. In 2026, as artificial intelligence amplifies data analysis, this capability will expand unless constrained.

7. Settlements replaced accountability

Legal settlements appear repeatedly across the timeline. Each resolved a complaint without admission of wrongdoing. Each included confidentiality provisions. Each reset the public narrative.

The files show how settlements served as pressure valves. They diffused outrage while preserving the underlying system. Plaintiffs received compensation. Institutions avoided precedent. The public lost insight.

If you believe civil settlements advance justice, these documents force you to reconsider their aggregate effect. In 2026, policymakers will face calls to limit confidentiality in cases involving public interest.

8. Jurisdictional arbitrage delayed enforcement

The Episton files map how cases bounced between jurisdictions. Investigations stalled as agencies debated authority. Evidence sat idle while prosecutors sought cooperation.

You see this tactic often in corporate crime. Here it appears weaponized.

Entities registered in offshore centers handled assets. Operations occurred in multiple countries. Victims resided elsewhere. No single authority owned the case.

This fragmentation benefited those with resources to navigate it. If cross border enforcement remains slow, similar structures will flourish.

9. Whistleblowers faced systematic deterrence

Several contributors to the files appear only through anonymized statements. Their correspondence reveals fear grounded in experience.

They describe professional retaliation, legal threats, and isolation. They reference earlier whistleblowers whose careers ended quietly. Some attempted internal reporting channels and received no response.

This matters because systems depend on insiders to fail safely. The Episton files show what happens when speaking up carries asymmetric risk. In 2026, whistleblower protections will remain theoretical unless institutions enforce them credibly.

10. The pattern predicts recurrence, not closure

The final shock lies in what the files imply about the future. You do not see an endpoint. You see adaptation.

After each exposure, structures evolved. Names changed. Vehicles relocated. Processes refined. Risk dispersed.

This is why the files alarm policymakers and investigators. They suggest the problem never centered on one individual. It centered on incentives that reward opacity.

As you look toward 2026, ask yourself which reforms address incentives and which merely punish symbols. Without systemic change, the next archive will surface under a different name.

Why this matters to you in 2026

You may feel detached from elite scandals. You should not. The Episton files expose fault lines that shape your economy, your governance, and your privacy.

If you work in finance, they question your compliance frameworks. If you work in technology, they reveal how data fuels power. If you work in media, they challenge your editorial risk calculus. If you vote, they complicate assumptions about accountability.

Debate will intensify over transparency laws, data regulation, and cross border enforcement. Expect resistance from institutions that benefit from complexity. Expect narratives that minimize systemic implications.

Your role as a reader does not end with outrage. It begins with scrutiny. Demand explanations that address structure, not scapegoats. Watch which reforms advance and which stall. The Episton files will not change the world by themselves. Your response to what they reveal might.

References

Epstein Financial Network Investigation Summary

https://www.icij.org/investigations/

Banking Compliance Failures in High Net Worth Client Cases

https://www.bis.org/publ/

Cross Border Enforcement and Jurisdictional Challenges

https://www.oecd.org/corruption/

Media Legal Risk and Investigative Reporting

https://www.cjr.org/

Data Brokerage and Privacy Risks

https://www.ftc.gov/

Whistleblower Protection Effectiveness Reports

https://www.whistleblowers.org/

Civil Settlements and Public Interest Transparency

https://www.law.harvard.edu/

Political Donations and Regulatory Influence Studies

https://www.opensecrets.org/